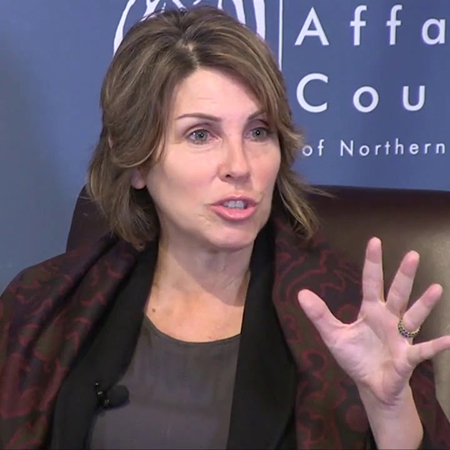

Amy Myers Jaffe is an energy consultant and leading expert on the geopolitics of oil, energy, security and risk, and an influential thought leader on global energy policy and sustainability. She is currently serving as Director of the Energy, Climate Justice, and Sustainability Lab and a research professor at New York University’s School of Professional Studies.

Jaffe is a regular contributor to the popular podcast “The Energy Gang” and a frequent media commentator in television and print media, including the New York Times, Financial Times of London, and the Wall Street Journal. A prolific author, Jaffe holds a career prize in energy economics from the US Association for Energy Economics and also served as the organization’s President in 2020.

Jaffe is a regular contributor to the popular podcast “The Energy Gang” and a frequent media commentator in television and print media, including the New York Times, Financial Times of London, and the Wall Street Journal. A prolific author, Jaffe holds a career prize in energy economics from the US Association for Energy Economics and also served as the organization’s President in 2020.

Jaffe’s current research focuses on energy and social justice in the United States, digital technology innovation and energy, the financial and energy security risks of climate change, and global energy geopolitics and security.

Ms. Jaffe has advised numerous organizations on climate risk strategy and scenarios analysis. She is frequently asked to testify on Capital Hill on matters related to US national security and US energy and climate change policy and has presented on climate change and energy to multiple governmental agencies such as the US National Intelligence Council, the European Central Bank, and numerous US state governments. She is a frequent contributor to the Aspen Institute Congressional program and the World Economic Forum where she most recently served on the Global Future Council on Net Zero Transition.

Ms. Jaffe has advised numerous organizations on climate risk strategy and scenarios analysis. She is frequently asked to testify on Capital Hill on matters related to US national security and US energy and climate change policy and has presented on climate change and energy to multiple governmental agencies such as the US National Intelligence Council, the European Central Bank, and numerous US state governments. She is a frequent contributor to the Aspen Institute Congressional program and the World Economic Forum where she most recently served on the Global Future Council on Net Zero Transition.

In Energy's Digital Future: Harnessing Innovation for American Resilience and National Security, Amy Myers Jaffe provides an expert look at the promises and challenges of the future of energy in a post-oil era, and argues the United States must embrace the digital revolution and foster American achievement. Energy’s Digital Future gives indispensable insight into the path the United States will need to pursue to ensure its lasting economic competitiveness and national security in a new energy age.

In Energy's Digital Future: Harnessing Innovation for American Resilience and National Security, Amy Myers Jaffe provides an expert look at the promises and challenges of the future of energy in a post-oil era, and argues the United States must embrace the digital revolution and foster American achievement. Energy’s Digital Future gives indispensable insight into the path the United States will need to pursue to ensure its lasting economic competitiveness and national security in a new energy age.

More books by Amy Myers Jaffe

China is streaking ahead of the US

in the energy transition race

"I’ve been buying EVs for more than 10 years. But innovations on the horizon will make a big difference to me—and lots of other skeptical consumers. As an energy and sustainability expert who has been driving EVs since 2014, I am committed to electric cars. But I won’t lie: My experience as an early adopter hasn’t been a totally smooth one."

Electrification is accelerating and widening the gulf between ‘petrostates’ like the US - who are rich in oil and gas and favoring fossil fuels as a solution to short-term energy security – and the electrostates like China, which is electrifying fast and dominating manufacturing of renewables. With guest Gerard Reid, co-host of Redefining Energy podcast.

Duke University's 'Rethinking Load Growth' has caused a stir in energy circles with a new perspective on the hottest issue of the moment: how to provide power for new data centers and other large consumers. Grid planners are scrambling now to understand integrating new loads without breaking the system or budgets.

Copyright 2025, Amy Myers Jaffe. All rights are reserved